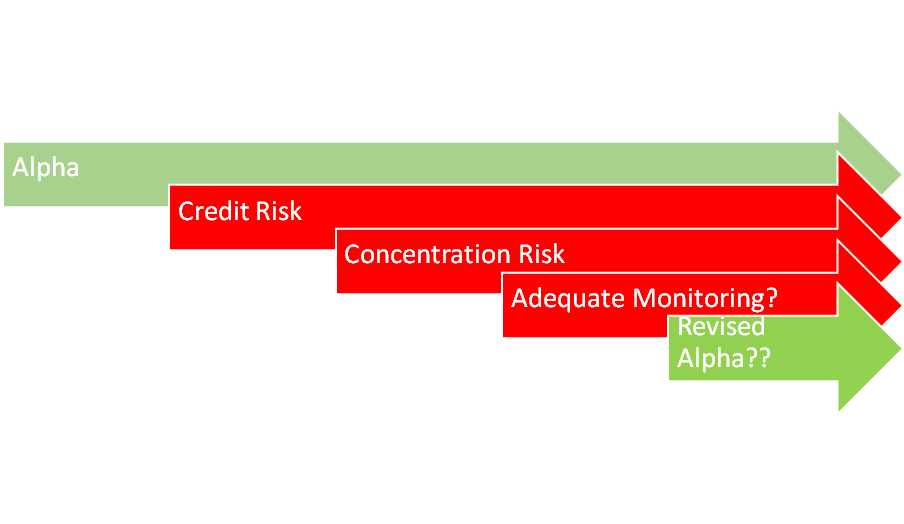

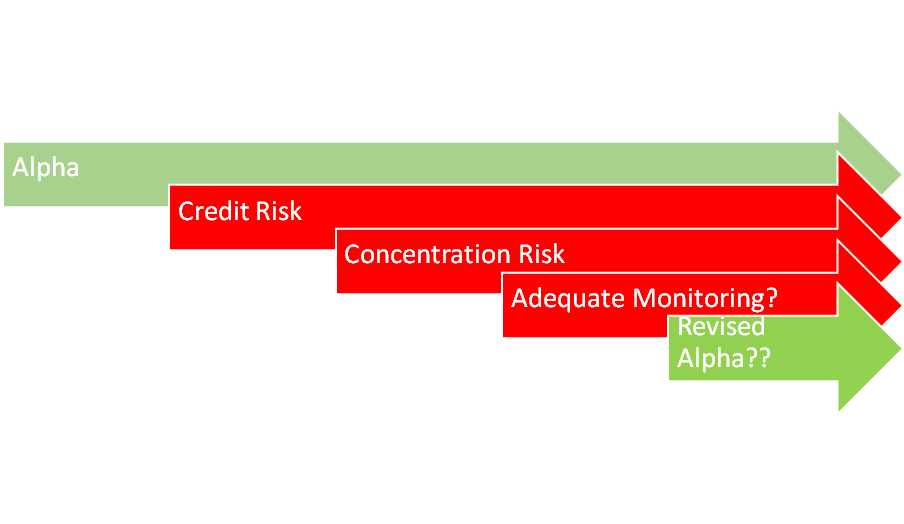

Credit portfolio of the investors may carry undue credit or concentration credit, this may lead to significant dilution in the actual ‘Alpha’ portfolio is able to generate. Alternatively, the portfolio may also be yielding too low. FairConnect’s credit health check may help the investor in establishing the red flags and may help fine tune the future investment strategy based of the investor.

Insurance Companies or Corporate Treasuries could establish the ‘Resilience of’ and ‘Risk to’ the ‘Alpha’ in their Bond Portfolio